Weekly Market Report

For Week Ending May 6, 2023

For Week Ending May 6, 2023

Mortgage interest rates fell slightly following the Federal Reserve’s recent decision to raise its benchmark short-term interest rate by a quarter percentage point this month, its 10th interest rate hike since March 2022. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.39% the week ending 5/4/23, up from 5.27% a year ago. Many economists expect mortgage interest rates will continue to soften over the year due to cooling inflation.

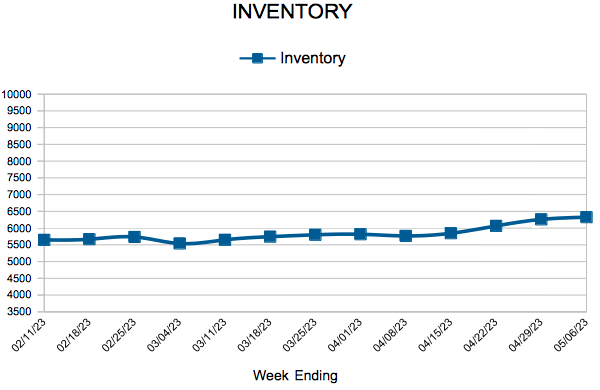

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 6:

- New Listings decreased 18.2% to 1,533

- Pending Sales decreased 23.4% to 1,096

- Inventory increased at 6,325

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 29, 2023

For Week Ending April 29, 2023

Homeownership remains a key driver to building wealth. According to a recent report from the National Association of REALTORS®, middle-class homeowners saw the median value of their homes appreciate $122,070, or 68%, over the last decade. Meanwhile, lower income homeowners saw a 75% gain in the median value of their homes, with an increase of $98,910 in wealth solely from home price appreciation, while upper income homeowners saw an increase of $150,810 in wealth from their homes in the last 10 years.

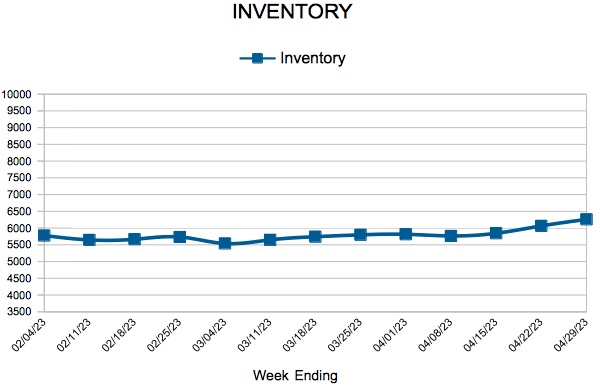

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 29:

- New Listings decreased 27.3% to 1,303

- Pending Sales decreased 26.2% to 1,045

- Inventory increased 2.7% to 6,259

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 22, 2023

For Week Ending April 22, 2023

A lack of existing-home supply has allowed U.S. homebuilders to capture a near-record share of housing inventory. According to the National Association of Home Builders (NAHB) Chief Economist Robert Dietz, one-third of current housing supply is new construction, far above the historical norm of 10%. With only 2.6 months’ of existing-home supply as of last measure, prospective buyers have been increasingly turning to the new home market, which, along with builders’ use of sales incentives, have helped support new home sales in recent months.

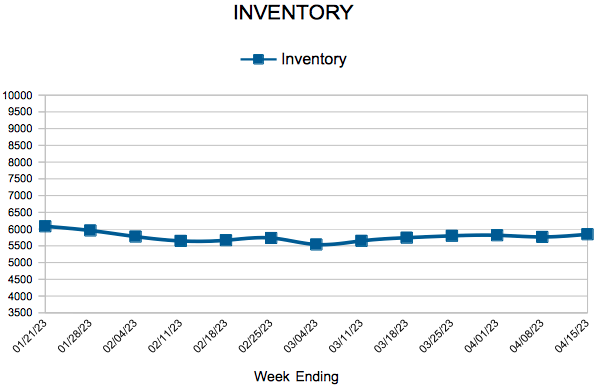

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 22:

- New Listings decreased 27.0% to 1,344

- Pending Sales decreased 17.0% to 975

- Inventory increased 5.0% to 6,065

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 15, 2023

For Week Ending April 15, 2023

Baby boomers—people ages 58 to 76—now make up the largest share of buyers and sellers nationwide, according to the National Association of REALTORS® 2023 Home Buyers and Sellers Generational Trends Report. Baby boomers represented 53% of sellers and 39% of buyers in transactions that occurred between July 2021 and June 2022. Millennials, once the leading share of homebuyers, came in second place, accounting for 28% of buyers according to the report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 15:

- New Listings decreased 13.4% to 1,321

- Pending Sales decreased 37.7% to 883

- Inventory increased 4.0% to 5,845

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 8, 2023

For Week Ending April 8, 2023

Housing affordability is slowly improving, according to ATTOM’s Q1 2023 U.S. Home Affordability Report. Among the 572 counties analyzed, 94% of median-priced single-family homes and condos were less affordable than their historical averages in the first quarter of 2023, falling from 99% in the fourth quarter of 2022. The portion of average wages needed for homeownership costs also declined slightly, with the typical total monthly mortgage payment (PITI) now requiring 29.9% of the average annual wage of $70,460, down from 31.2% in the fourth quarter last year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 8:

- New Listings decreased 36.5% to 1,007

- Pending Sales decreased 31.9% to 893

- Inventory increased 4.8% to 5,766

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 24

- 25

- 26

- 27

- 28

- …

- 55

- Next Page »