For Week Ending July 18, 2020

The latest figures released by the Department of Commerce show total housing starts in June rose 17.3% to a seasonally adjusted annual rate of 1.19 million units, with single-family units leading the way with a 17.2% increase to a seasonally adjusted rate of 831,000 per year. With demand for housing strong across most of the nation, this increase in new construction is welcome, but will do little to significantly impact the lack of housing inventory nationwide.

In the Twin Cities region, for the week ending July 18:

- New Listings decreased 9.1% to 1,753

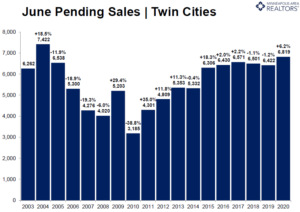

- Pending Sales increased 10.2% to 1,541

- Inventory decreased 27.2% to 9,339

For the month of June:

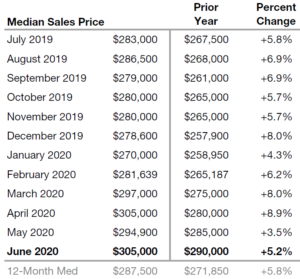

- Median Sales Price increased 5.2% to $304,995

- Days on Market increased 2.4% to 42

- Percent of Original List Price Received decreased 0.4% to 99.6%

- Months Supply of Homes For Sale decreased 29.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.