For Week Ending December 21, 2024

For Week Ending December 21, 2024

New-home purchases accounted for 15% of home sales over the past year, the

highest share since 2007, while existing-home purchases accounted for 85%,

according to a recent report from the National Association of REALTORS®. Among

new-home buyers, 42% were most often looking to avoid renovations and

problems with mechanical systems, while 31% of existing-home buyers felt

previously owned homes represented a better overall value.

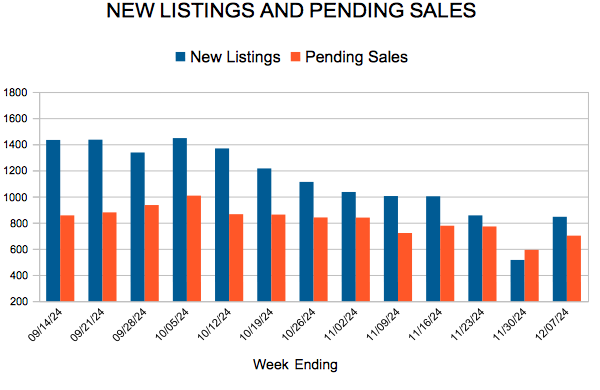

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 21:

- New Listings decreased 1.0% to 477

- Pending Sales increased 3.1% to 605

- Inventory increased at 7,832

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 3.4% to $375,000

- Days on Market increased 25.0% to 50

- Percent of Original List Price Received increased 0.2% to 97.6%

- Months Supply of Homes For Sale remained flat at 2.3

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.