November 27, 2024

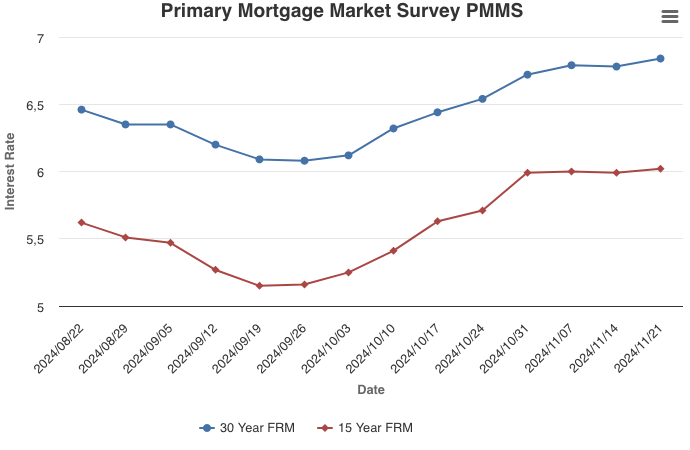

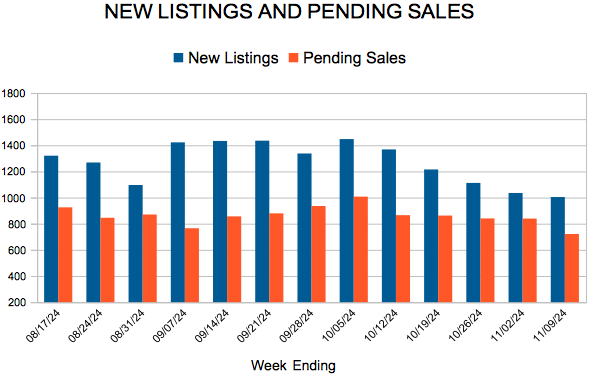

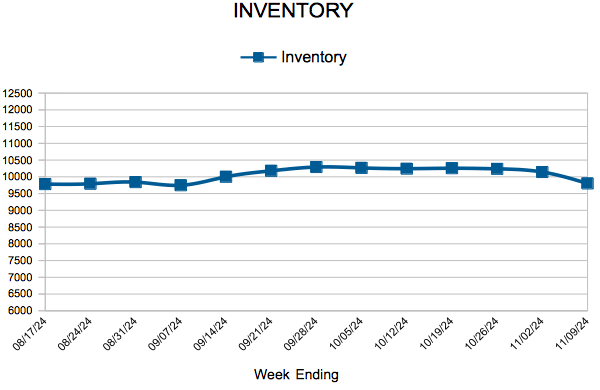

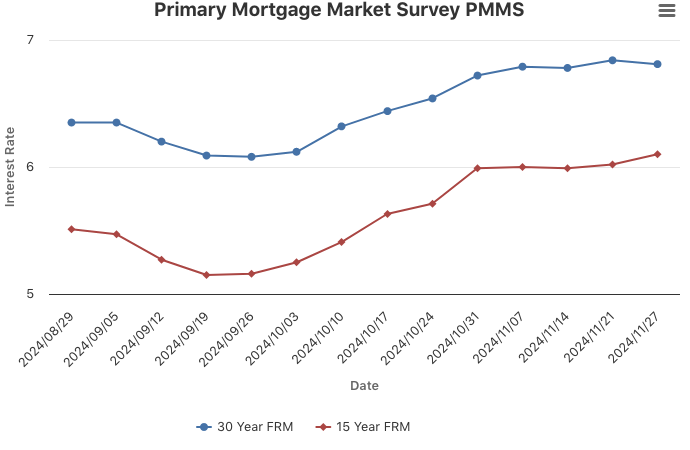

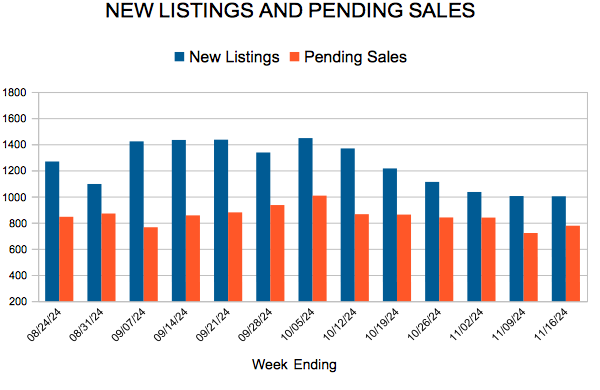

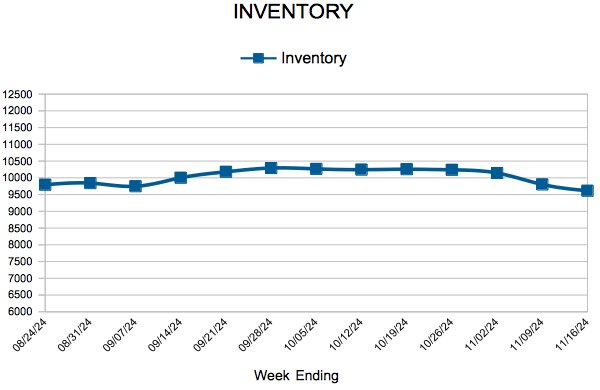

The 30-year fixed-rate mortgage moved down this week, but not by much. Rates have been relatively flat over the last few weeks as the market waits for more clarity on specific economic policies. Potential homebuyers are also waiting on the sidelines, causing demand to be lackluster. Despite the low sales activity, inventory has only modestly improved and remains dramatically undersupplied.

Information provided by Freddie Mac.

For Week Ending November 16, 2024

For Week Ending November 16, 2024