Inventory

Weekly Market Report

For Week Ending May 4, 2024

For Week Ending May 4, 2024

The best time to sell a home is in the first half of the year, according to a new report from ATTOM. An analysis of more than 59 million home sales from 2011 to 2023 showed that the months of May, February, and April offer the highest seller premiums, at 13.1%, 12.8%, and 12.5% above market value, respectively. The best day of the year to sell a home? May 27, with a seller premium of 16.2%, according to the report.

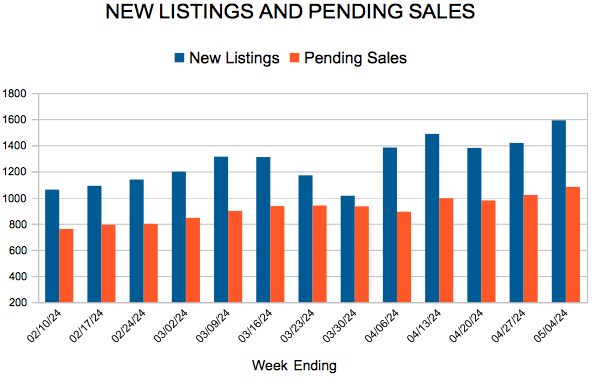

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 4:

- New Listings increased 0.2% to 1,591

- Pending Sales decreased 2.8% to 1,082

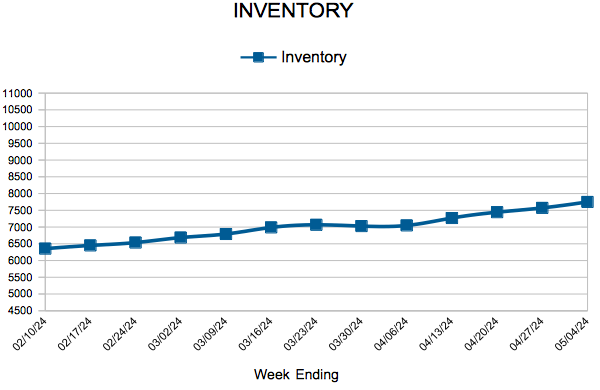

- Inventory increased 14.7% to 7,750

FOR THE MONTH OF MARCH:

- Median Sales Price increased 2.8% to $366,000

- Days on Market decreased 6.9% to 54

- Percent of Original List Price Received increased 0.2% to 98.8%

- Months Supply of Homes For Sale increased 26.7% to 1.9

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

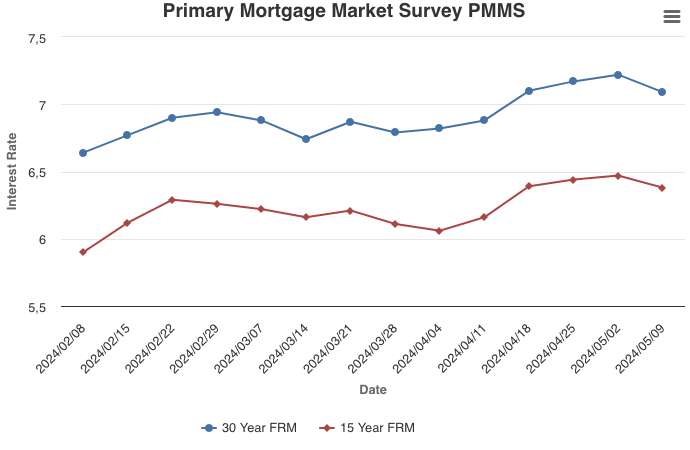

Mortgage Rates Decrease for the First Time Since March

May 9, 2024

After a five week climb, mortgage rates ticked down following a weaker than expected jobs report. An environment where rates continue to hover above seven percent impacts both sellers and buyers. Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated. These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.

Information provided by Freddie Mac.

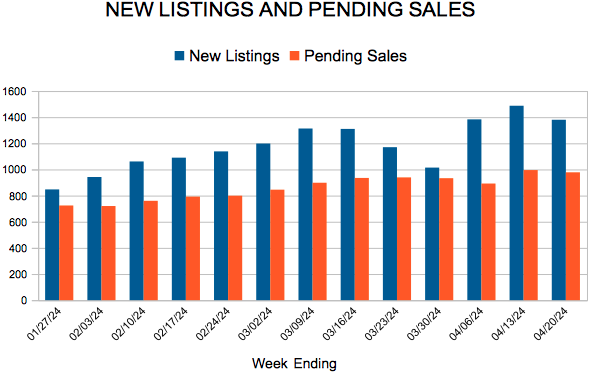

New Listings and Pending Sales

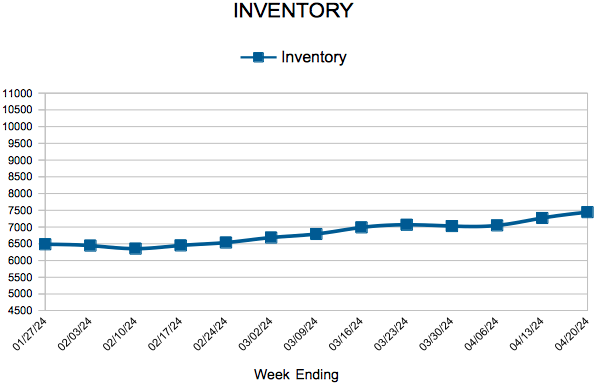

Inventory

Weekly Market Report

For Week Ending April 27, 2024

For Week Ending April 27, 2024

Housing affordability improved for the second straight quarter, according to ATTOMS’s Q1 2024 Home Affordability Report, which found major homeownership expenses required 32.3% of the average national wage in the first quarter of the year, down from 33.7% in Q4 2023. Median-priced single-family homes and condos were less affordable compared to historical averages in 95% of counties nationwide, a slight decrease from the previous quarter, when 99% of counties were considered less affordable.

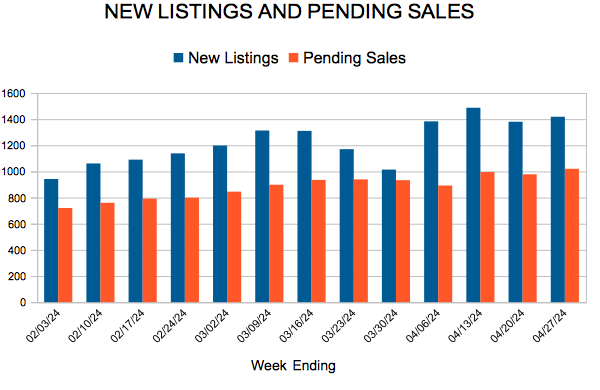

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 27:

- New Listings increased 5.7% to 1,418

- Pending Sales decreased 2.2% to 1,020

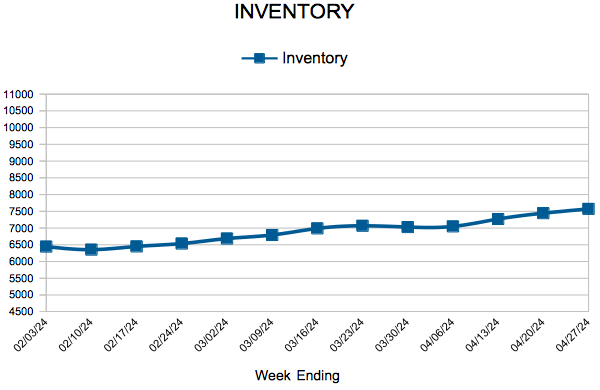

- Inventory increased 13.3% to 7,572

FOR THE MONTH OF MARCH:

- Median Sales Price increased 2.8% to $366,000

- Days on Market decreased 6.9% to 54

- Percent of Original List Price Received increased 0.2% to 98.8%

- Months Supply of Homes For Sale increased 26.7% to 1.9

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

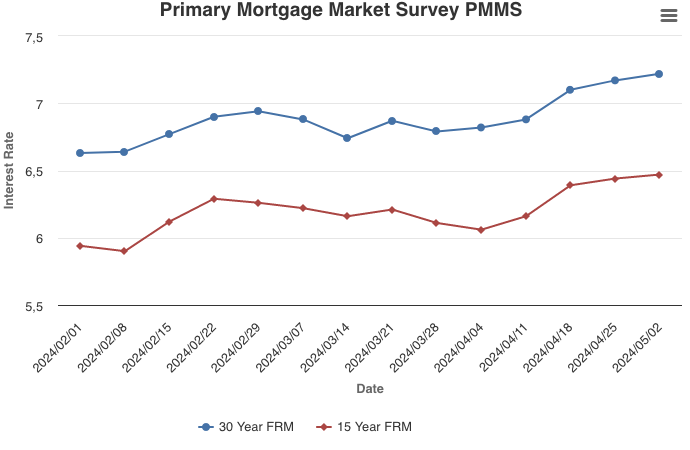

Rates Increase Again and at a Key Moment for the Housing Market

May 2, 2024

The 30-year fixed-rate mortgage increased for the fifth consecutive week as we enter the heart of Spring Homebuying Season. On average, more than one-third of home sales for the entire year occur between March and June. With two months left of this historically busy period, potential homebuyers will likely not see relief from rising rates anytime soon. However, many seem to have acclimated to these higher rates, as demonstrated by the recently released pending home sales data coming in at the highest level in a year.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 32

- 33

- 34

- 35

- 36

- …

- 119

- Next Page »