By David Arbit on Wednesday, July 18th, 2018

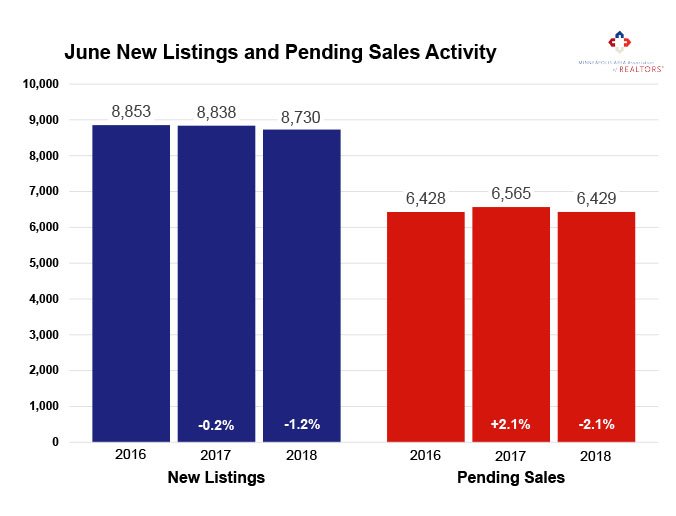

Seller activity was relatively flat in June while buyers pulled back somewhat. For the first time since 2010, new listings surpassed 9,000 in May of this year. That’s encouraging, even though June seller activity was down slightly compared to last year. Increasing or steady seller activity combined with a cool down in demand is consistent with a loosening marketplace. That said, buyers shopping this spring and summer will still face stiff competition. While sellers are receiving full-price-or-better offers in record time, listings still need to show well and be priced properly. June marked the seventh consecutive month of year-over-year declines in closed sales, likely reflecting the shortage of homes for sale.

Strong demand and low supply means sellers yielded an average of 100.3 percent of their list price in June, a record high for any month since at least the beginning of 2003. The shortage is especially noticeable at the entry-level prices, where multiple offers and homes selling for over list price have become increasingly common.

The move-up and upper-bracket segments are less competitive and better supplied. Yes, the housing market is tight out there—sometimes frustratingly so. But over 54,000 Twin Cities buyers and sellers have managed to successfully transact real property so far this year.

June 2018 by the Numbers (compared to a year ago)

Sellers listed 8,730 properties on the market, a 1.2 percent decrease

Buyers closed on 7,063 homes, a 8.1 percent decrease

Inventory levels for June fell 15.9 percent compared to 2017 to 11,374 units

Months Supply of Inventory was down 14.8 percent to 2.3 months

The Median Sales Price rose 5.7 percent to $271,900, a record high

Cumulative Days on Market declined 14.6 percent to 41 days, on average (median of 16)

Changes in Sales activity varied by market segment

Single family sales sank 7.1 percent; condo sales rose 8.4 percent; townhome sales declined 13.7 percent

Traditional sales fell 6.6 percent; foreclosure sales sank 39.3 percent; short sales dropped 39.0 percent

Previously-owned sales fell 7.4 percent; new construction sales decreased 4.3 percent